Frequently Asked Questions about the College's Budget Situation

February 2009

If you have questions or need clarification about any of the postings here, please feel free to contact the Finance office: aevans2@wellesley.edu.

-Andrew B. Evans Vice President for Finance and Treasurer

A. FAQ’s relevant to the Budget Cuts

1. How has the global and U.S. economic downturn impacted Wellesley College?

A declining stock market, the collapse of financial services companies, the sub-prime mortgage problem, weakened capital markets and significant government interventions have or will have an impact on the College’s endowment, debt and operations. The direct result will be a significant reduction in the level of support the operating budget receives from the endowment. A prolonged economic slowdown will also have a meaningful impact on charitable giving to the College, and to students’ need for financial aid. Thus two of the College’s main sources of revenue – endowment income and annual gifts to the College – are likely to decline and fall short of the targets we had set in our multi-year financial model. The third major source of revenue, the comprehensive fee, cannot be increased to the level necessary to cover our expected revenue shortfall of approximately $20 million in fiscal year 2011. On the contrary, to recognize the financial difficulty students and their families also may be experiencing, in January Wellesley’s Board of Trustees approved a comprehensive fee increase for FY 2010 of 3.9%, the lowest percent increase in the past eight years.

2. How is the College dealing with this $20 million financial challenge?

As the president's recent memorandum on “Budgetary Actions” noted, we have instituted a number of actions in a variety of categories: across the board measures (e.g., salary freeze); strengthening our sense of priorities (e.g., moving forward with academic planning and maintaining our financial aid program); streamlining operations and services (e.g., reducing redundancies by centralizing); tightening our belts (e.g., consolidating or centralizing services that are currently decentralized); and making the organization more efficient. We invite you to visit the president’s Web page at www.wellesley.edu/PublicAffairs/President/announcements.html for more information.

The president and the senior staff are reviewing all programs, services and activities currently supported and their relation to the core mission of the college. It is clear that the actions that we will be taking will change the way we are organized, the work we do and the services we provide. It is also clear that this will result in reductions in most areas. Some of these changes will be introduced locally, some divisionally and some campus wide. This process has already begun and will continue this year and next year. To the extent possible, we will continue to focus on “how can we do our work differently and better,” rather than thinking only about “what to cut.”

3. How much is saved by freezing salaries?

Freezing salaries for FY2010 (which in turn reduces the planned salary increase for FY 2011) saves approximately $4 million.

4. Isn’t additional use of income from endowed funds a possibility?

Yes. Two items have been identified in the solution to the financial challenge. First, we have asked departments across the college to identify income from endowed funds that could be used to offset operating budget expenditures. Academic departments and other areas of the College that hold these funds have been very responsive to our requests, and we have identified about $1 million in additional use of endowed funds.

Second, it is commonplace for colleges and universities to look to all sources of funds, including endowment funds, to meet the overhead costs of operating the institution. Colleges and universities often have dealt with this issue through the levy of administrative assessments against endowment distributions in order to recoup some of these overhead costs. Beginning for FY 2010, we are recommending that Wellesley have such an assessment on endowed funds. With assistance from our legal counsel, we have prepared a document outlining the guiding principles for endowed fund assessments, which was reviewed by the Finance Committee of the Board this past meeting in January. Currently, for federal funds received by the College, there is a federal indirect cost rate of 27.3 percent in effect since 2006. This rate seems too high and we would propose an administrative charge in the range of 5 to 10 percent. We believe that this administrative charge will help reduce the $20 million challenge by approximately $1.2 million.

5. So if freezing salaries in #3 above saves $4 million, and the items in #4 above save $2.2 million, where will the remainder come from to meet the $20 million target?

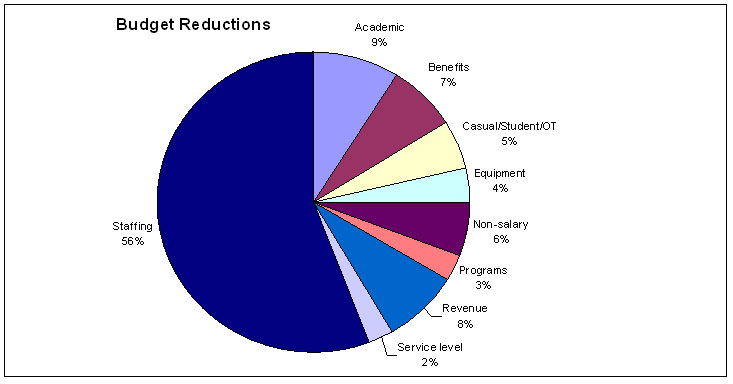

The following chart reflects the budget reductions by category:

Examples of these reductions are:

• Academic: reduction in leave replacements

• Benefits: various benefit changes to be determined

• Casual/Student/OT wages: Reduce Facilities OT to Health, Safety Code, emergency only

• Equipment: Stretch out replacement cycles for desktop computers, work vehicles, vehicle equipment repairs

• Non-salary: Less travel, reduce printing, reduce memberships

• Programs: Reduction in Commencement expense – no tent

• Revenue: Increase net revenue target, tighten student account collection

• Service Level: Reduce floor care, reduce bus transportation

6. Are there areas where funding will not be cut?

Some areas such as financial aid will be protected longer than others. As our current policy states, the College is committed to maintaining our need-blind financial aid program and meeting the full demonstrated need of admitted U.S. students. Financial aid is critical to recruiting and retaining the highest quality student body, and so we will do our best to retain our financial aid program through the current financial downturn and budget cuts. Similarly, we remain committed to offering a high quality academic program and to do so we need to continue a competitive compensation program to recruit and retain faculty. In general, despite the economic challenge, our primary focus will continue to be the academic and intellectual life of students and faculty.

7. Will there be workforce reductions?

Planned reorganizations and the need to meet the $20 million shortfall will result in a reduction in the number of employees. Some of this reduction will come from attrition, from retirements, and the remainder will have to come from layoffs. In total, we anticipate reducing the College workforce by between 75 and 85 positions by the end of this fiscal year. These decisions will be communicated first to those people directly affected. We have also offered a retirement incentive program. We believe that this generous package is an appropriate way to signal the college’s appreciation to employees who will be 60 years old or older and have 10 or more years of service by December 31, 2009. We recognize that many would welcome the opportunity to actively shape their retirement decisions. This program has been offered to all eligible administrative employees and notification with a detailed description of the program has been delivered to those employees. A program for union employees will also be offered. An early retirement program already exists for faculty, and we are looking into the possibility of offering an additional one-time enhanced retirement incentive program to faculty timed to correspond with the hiring cycle.

8. Won’t these workforce reductions result in diminished programs and services?

The president and the senior staff are reviewing all programs, services and activities currently supported and their relation to the core mission of the college. It is clear that the actions that we will be taking will change the way we are organized, the work we do and the services we provide. It is also clear that this will result in reductions in most areas. Some of these changes will be introduced locally, some divisionally and some campus wide. This process has already begun and will continue this year and next year. To the extent possible, we will continue to focus on “how can we do our work differently and better.”

9. Does the College set aside resources in a reserves account to provide flexibility in a downturn?

Yes. For the first time in some years, two years ago the College began to develop reserves. The planned accumulation of reserves both from FY 2009 and for FY 2010 will be needed to accomplish the actions we are taking to address the $20 million challenge. A large part of the reserves will be used for one-time expenditures that will be made to reduce costs in the longer term. One example is the costs of the voluntary retirement program and the costs of the severance packages that will be offered to employees who are laid off. In these volatile economic times we also need to maintain a base level of reserves to meet unforeseen shocks to our budget, such as a rapid return to high energy prices or higher than anticipated financial aid needs. The reserves alone are not enough to address our financial shortfall in the longer term.

10. I understand that the College has more than a $1 billion endowment. Why don’t we simply take more money from the endowment to solve our financial issues?

See Professor Levine’s related questions and answers below.

11. Will renovation of campus facilities continue?

Yes, but only if projects are fully funded by donations (such as Alumnae Hall), including funds contributed to the endowment to support the facility’s operating expenses, or through funds in the College’s asset renewal and replacement reserve. This reserve will be funded annually by allocations each year from our operating budget specifically to keep our physical infrastructure modern and to prevent costly deferred maintenance of our facilities.

12. As the economy rebounds, will the College abandon its cost reduction efforts?

No. College expenditures have increased considerably over the last decade; much of this was planned, some of it was not. It makes good sense, then, to conduct a comprehensive review of our expenditures so we can reallocate our resources on the College’s priorities.

13. Are we through the worse once we face the $20 million challenge in FY 2011?

Our current projections show that the endowment distribution in FY 2012 will be lower than the amount in FY 2011. This is based on projected endowment returns for FY 2009 and FY 2010. Through the work of the senior staff in reviewing budget savings ideas, there were several ideas that we are still reviewing further. Our hope is that some of these ideas may be implemented if needed for any shortfall in FY 2012.

B. Relevant posting by Economics Department and Budget Advisory Committee (BAC) chair Phillip B. Levine

The following posting appeared on the Wellesley College faculty blog by Professor Phil Levine and is included here with his permission:

As chair of the Economics Department and the Budget Advisory Committee, I'd like to take this opportunity to start a discussion of budget issues that the College will have to address in the coming weeks and months. I'd first like to make the disclaimer that anything I post here represents my own opinions and not those of my department or the BAC, but my two roles do provide me with useful insights (I hope!) into these issues.

The types of questions that come to my mind as issues that need to be addressed include:

1) What has happened to the value of our endowment?

2) How does that affect our operating budget?

3) Why can't we just spend more money from the remaining endowment since it is still very large?

4) How can we make up the gap in our operating budget if large cuts really are necessary?

First let's tackle the value of the endowment and how much we spend from it. Not surprisingly, all of this is reasonably complicated. The first part of the problem, in particular, is not straightforward at all. It turns out that we don't really know exactly how much money we've really lost. The reason for this is that the College invests in a portfolio that is considerably more complex than that which we do with our retirement funds. It is easy to assess the value of stocks and bonds, so you can obtain a balance in your retirement account anytime you want (if you have the guts to do so!). The College invests in a lot of things that are very difficult to determine their value. Some of the endowment is invested in natural resources like oil and gas or in forests. Other parts of the endowment are invested in venture capital, which invests in other businesses in which we essentially become part owners. In both cases, knowing the value of the forest or the value of the businesses is not an easy thing to do. Other institutions are in a similar situation, so when you hear reports with specific declines in endowment values, that is a bit misleading. What is typically reported is the decline in the part of the endowment value that we can easily measure (i.e. stocks and bonds). At this point, the easiest thing to do is to go with a ballpark estimate of a reduction in the value of the endowment of about 25 percent. If you read the article in The New York Times this morning [Feb. 5, 2009], this seems like a typical value based on what schools actually know. With an endowment value that used to be around $1.6 billion, that means we have lost in the vicinity of $400 million.

The second question is about the impact of losing $400 million in endowment value on our operating budget. The key determinant in estimating this impact is the rate at which we spend funds from the endowment. Again, the rules we use to determine that spending rate are not straightforward. The simplest approximation of those rules is that we spend around 5 percent of the endowment's value every year to fund operations. Before discussing why 5 percent is a reasonable number, we can use that number to estimate the impact on the operation budget of a $400 million loss. Simply multiplying the two numbers means that we will draw $20 million less per year from the endowment than we would have if the market hadn't crashed. This $20 million figure is exactly the number that Andy Evans talked about at [Academic] Council as the amount we needed to cut from the 2010-2011 budget. He arrived at that number using all the data available on actual endowment values, the specifics of our spending policy, etc. The fact that my simple calculations provide the same number suggests that the simplifications I have used are reasonable.

Where does that 5 percent spending rate come from? Again, I will make some important simplifications to clarify the central issues. The starting point is the value provided by the investment office (and one that, as an economist, seems reasonable) is that the College can expect to receive, ON AVERAGE, an 8.5 percent rate of return on its investments over the course of a year. Obviously some years will be better than others and this one certainly was a bad one, but over a long period of time, averaging the good years and the bad years, 8.5 percent is a reasonable estimate of what we can expect to receive. This number is a bit misleading, however, because a dollar today is not worth the same thing today as it is tomorrow. Inflation tends to erode the value of that dollar over time. A typical assumption that economists use regarding the inflation rate is 3 percent, which also represents a long term average of high and low inflation years. If you had $100 today, then you would need to have $103 a year from now to be able to afford the same amount of stuff. This means that if you had $100 today and received an 8.5 percent investment return, you would have $108.5 next year. But your real gain in the amount of stuff you could by is $5.50 ($108.5 - $103) because of inflation. This is something that economists call the real rate of return and is obtained by subtracting the inflation rate (3 percent) from the "nominal" rate of return (8.5 percent) to get the 5.5 percent. If we spend greater than 5.5 percent of our endowment value, on average, we are actually reducing the value of our endowment over time. A spending rate of about 5 percent means that we are allowing for a small amount of real endowment growth over time.

The question then becomes about philosophy regarding the purpose of the endowment and whether we want it to shrink or grow over time. There is no right answer to this question. The issue is one about whether we want to emphasize the current strength of the institution over the future strength of the institution or vice versa. That last statement requires an assumption that spending is related to the strength of the institution. Although reasonable people could differ about this assumption, I would argue that the ability to spend more on buildings, faculty, support staff, etc., is related to the ability of the institution to meet its core mission. If we maintain this assumption, then this means that spending more of the endowment now means trading off future strength for current strength. Spending less now means emphasizing future strength over current strength. The current approach of spending slightly less, on average, than the endowment return mainly balances current strength against future strength, with a bit of an emphasis on the future. Again, this is a philosophical question with no right answer, but one could at least acknowledge that there is a rationale for a policy like this.

I'll try to post more tomorrow, particularly if we get a ton of snow! [We did.]

Phil

NEXT POSTING:

Where I left off was a discussion of general endowment spending and I provided a justification for a policy of a spending rate of around 5 percent. I would argue that this is a good policy in the long-term, but it begs the question of whether or not we can spend more briefly to weather a particular episode of hard times. I think there are multiple components in answer to this question. The simplest answer is that, to some extent, we do. One of the simplifications I made earlier was to ignore the fact that we have a spending policy that allows taking a bit more out of the endowment during tough times (up to 5.5 percent) and a bit less during good times (as low as 4.5 percent). Trustees are the ones who get to set spending policy and my guess is that we will be at that cap. The problem is that even if we go up to 5.5 percent, our draw from the endowment will still go down a lot. It would require going significantly above that cap to significantly smooth our spending. A second part of the answer is that the trustees do have the authority to spend supplemental amounts on specific projects that go beyond normal spending. For instance, that's how we paid for the Paint Shop clean up. One could argue that we are in such a position now and we should be asking the trustees for temporary additional spending authority to make it through the next couple of years. The argument against doing so is that it would be unrealistic to expect the endowment to return to previous levels, let alone grow above that, in the foreseeable future. This means that the budget impact of lower endowment values is not a matter that will only last for a year or two. It will go on for the foreseeable future as well. If the problem is a long-term one, long-term solutions are needed and that would mean cutting spending to live within our means now.

The next issue is how to cut $20 million from the budget. Apparently, we have already made significant strides in doing that by accepting a salary freeze for next year. It is my understanding that this change saves $5 million of the $20 million. Even if we go back to normal rates of salary increases next year, that one time freeze keeps our base pay lower, so that $5 million will be saved next year as well relative to what we would get paid otherwise. That still leaves $15 million. From conversations I have had with others and posts I have seen on faculty/staff, I think the magnitude of a number like that is something that people have not yet grasped. For those who have ideas about how to save money on campus, just try doing some back of the envelope calculations about how much money those changes would save. Buying cheaper pencils, turning thermostats down at night, reducing alcohol purchases and the like may all be very good ideas and things we should proceed with, but none of them save a ton of money. If we are going to restrict our cuts to things that save $10,000 or $20,000 at a time, we need to come up with a very long list of those things. In the end, my guess is that this exercise would never get us even close to the $15 million in remaining cuts needed. Think about it this way. Total compensation (including salary and fringes) is in the vicinity of $150 million. Financial aid is over $40 million. If we take those two items off the table, that means that $190 million of a $220 million budget is off the table. There is only $30 million left and we would need to cut half of that to get to $15 million in savings from the non-compensation/financial aid parts of the budget. (I should note that I'm doing this from home and listing this numbers from memory, so they may be off a little. The point still stands, though). The remainder includes things like heat, electricity and food in the dining halls, which are hardly discretionary items.

This is why a reduction in the size of the College's workforce is necessary. Some attrition/retirements may make up some of this reduction, but presumably not all of it and this is where layoffs come into the picture…The decision to layoff workers is one that nobody takes lightly. Nevertheless, getting to the magnitude of the dollar cuts needed to balance the budget is very, very difficult without taking this step.

Phil

********************************

Phillip B. Levine Class of 1919 Professor Chair, Department of Economics Wellesley College

|